Expert IRS Tax Audit

- Home

- Expert IRS Tax Audit

Expert IRS Tax Audit Representation

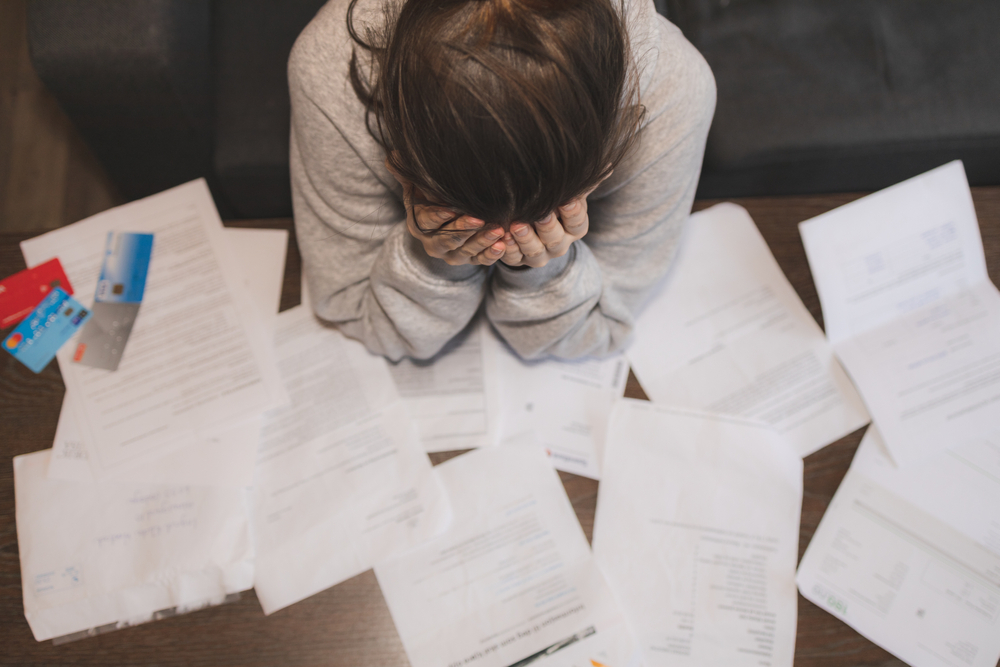

Facing an IRS tax audit can be an overwhelming experience for individuals and businesses alike. We provide professional IRS tax audit representation and support across California, New York, New Jersey, Florida, and Pennsylvania.

Our team of seasoned tax professionals is dedicated to protecting your rights and ensuring a fair and accurate audit process.

Dealing with an IRS tax audit doesn’t have to be stressful. We stand by you every step of the way, providing expert guidance and dedicated representation to ensure your case is handled with the utmost care and professionalism.

California Tax Audits

California has some of the most stringent tax regulations in the country. Our team is well-versed in California tax laws and specializes in defending against audits related to personal income tax, business tax, and sales tax issues.

New York Tax Audits

New York State is known for its aggressive tax enforcement. We provide robust audit defense services for individuals and businesses, addressing issues such as residency audits, income allocation, and sales tax compliance.

New Jersey Tax Audits

Navigating a New Jersey tax audit requires a deep understanding of state-specific laws. We offer comprehensive support for audits involving corporate income tax, partnership audits, and individual income tax assessments.

Florida Tax Audits

While Florida does not have a state income tax, audits related to sales and use tax, as well as corporate tax, can still be challenging. Our team provides expert guidance to ensure compliance and defend against any disputes.

Pennsylvania Tax Audits

Pennsylvania’s complex tax system can lead to unexpected audit issues. We specialize in resolving audits involving personal income tax, business taxes, and the state’s unique property tax assessments.

Pennsylvania Tax Audits

Pre-emptive Tax Review: Our experts review your financial records and tax filings annually to identify and correct any potential audit triggers. Compliance Guidance: We provide ongoing guidance to ensure your financial practices align with IRS and state regulations, reducing the risk of future audits. Record Keeping Support: Proper documentation is crucial for audit defense. We help you establish and maintain a robust record-keeping system to support your tax positions.

Experienced Audit Representation

With extensive experience in federal and state tax laws, our team is equipped to handle even the most complex audits. Whether you're being audited for income discrepancies, deductions, or compliance issues, we provide strategic representation to safeguard your financial interests.

State-Specific Expertise

Each state has its own unique tax regulations and compliance requirements. Our specialized knowledge in California, New York, New Jersey, Florida, and Pennsylvania ensures that we can address state-specific issues effectively, minimizing your exposure to penalties and additional taxes.

Comprehensive Audit Support

Pre-Audit Preparation: We review your financial records, tax returns, and relevant documentation to identify potential audit risks and prepare you thoroughly for the audit process. IRS Communication Management: From the initial audit notice to final resolution, we handle all communications with the IRS on your behalf, ensuring clear and accurate responses to any inquiries. Documentation & Evidence Gathering: Our team assists in gathering and organizing the necessary documentation to support your tax return positions, reducing the likelihood of misunderstandings or adverse outcomes. Audit Défense & Negotiation: We advocate for your best interests during the audit process, negotiating with IRS agents to achieve the most favourable outcome possible.

Blogs

Let’s See Our Latest Blogs

Stay updated with our latest insights and tips on tax and business trends. Explore our blogs for expert advice and valuable information.

Navigating the tax landscape can be daunting for many individuals and businesses. The complexity

In the ever-evolving landscape of business management, outsourcing has become a strategic tool for

Taxes can be a complex and overwhelming topic for many individuals and businesses. However,