Personal Tax

- Home

- Personal Tax

Personal Tax Accountant Services

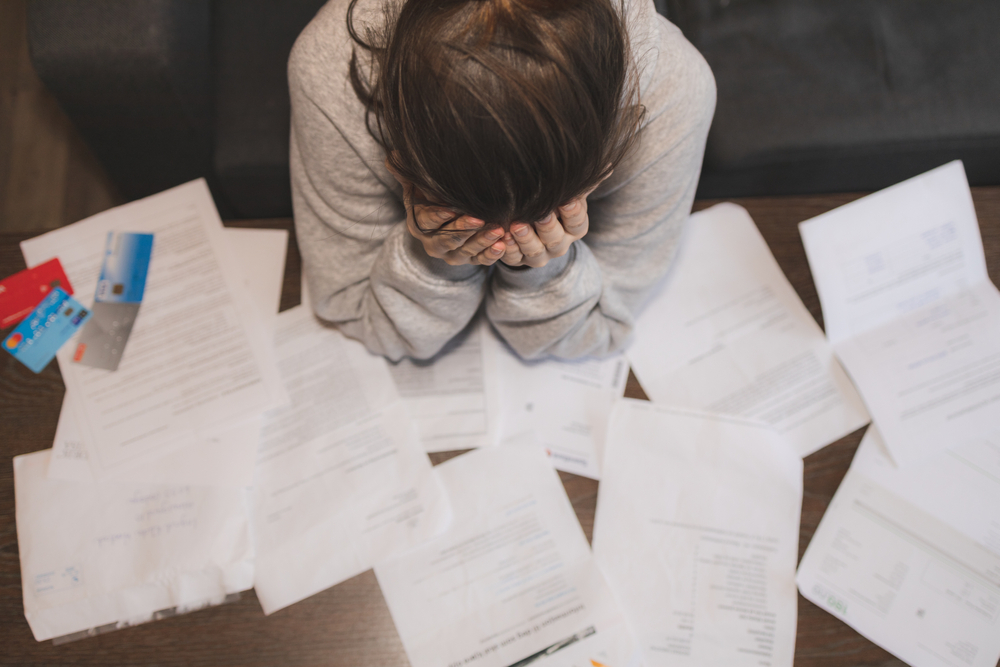

Navigating the complexities of personal taxes can be overwhelming, especially with constantly changing tax laws and regulations. That’s where we come in. Our personal tax accountant services in the USA are designed to take the stress out of tax season, ensuring you maximize your refunds and stay compliant with all tax requirements.

Expert Knowledge of U.S. Tax Laws

Our team of certified tax accountants is well-versed in the latest federal, state, and local tax laws. We stay updated on tax code changes to provide you with the most accurate and beneficial tax strategies.

Personalized Tax Solutions

We understand that every individual’s financial situation is unique. Our personalized approach means we take the time to understand your specific needs, tailoring our services to ensure you receive the maximum tax benefits.

Accuracy and Compliance

Filing your taxes correctly is crucial to avoiding penalties and audits. Our meticulous attention to detail ensures that your tax returns are accurate and fully compliant with all legal requirements.

Maximizing Refunds and Minimizing Liabilities

Our goal is to help you keep more of your hard-earned money. We diligently search for all eligible deductions and credits, ensuring that you receive the maximum refund or minimize your tax liability.

Year-Round Support

Tax planning isn’t just for tax season. We offer year-round support to help you make informed financial decisions that optimize your tax position and prepare you for future filings.

Tax Extension

If you need more time to prepare your taxes, we can help you file for a tax extension. Filing an extension gives you extra time to gather your documents and ensure your return is accurate.

Individual Tax Preparation

We simplify the tax filing process, making sure you claim every deduction and credit available to you, whether you’re an employee, freelancer, or retiree.

Tax Planning and Strategy

Effective tax planning can save you money in the long run. We work with you throughout the year to develop strategies that minimize your tax burden and prepare you for upcoming tax obligations.

IRS Audit Representation

If you ever face an IRS audit, our experienced tax professionals will represent you, ensuring your rights are protected and helping you navigate the audit process smoothly.

Amended Tax Returns

If you’ve discovered errors or missed deductions on past tax returns, we can help you file amended returns to correct those issues and recover any additional refunds you’re owed.

Estate and Trust Tax Services

We provide specialized tax services for estates and trusts, helping you manage the complexities of these areas with expertise and care.

Blogs

Let’s See Our Latest Blogs

Stay updated with our latest insights and tips on tax and business trends. Explore our blogs for expert advice and valuable information.

Navigating the tax landscape can be daunting for many individuals and businesses. The complexity

In the ever-evolving landscape of business management, outsourcing has become a strategic tool for

Taxes can be a complex and overwhelming topic for many individuals and businesses. However,